Foundation Support - December 21 & 28, 2015

Foundation Support: Make The Rotary Foundation Your Charity Of Choice

By Roy Balfour and Steve Sager

.jpg) Each year, Rotarians like you in District 7910 make a positive impact and improve the lives of thousands of people locally and throughout the world. This past year, you have provided for the hungry and elderly, donated books and dictionaries to young learners, assisted those with special needs, and improved communities by building playgrounds and parks.

Each year, Rotarians like you in District 7910 make a positive impact and improve the lives of thousands of people locally and throughout the world. This past year, you have provided for the hungry and elderly, donated books and dictionaries to young learners, assisted those with special needs, and improved communities by building playgrounds and parks.That was just in our Rotary district alone. Internationally, you have come up with creative ways to provide clean water to people, provided needed medical and dental treatments, solved sanitation problems, donated supplies to schools and orphanages, provided needed equipment to firefighters and other first responders, built community facilities, and created goodwill everywhere. Many of these projects were done with funding from The Rotary Foundation.

We hope that you make The Rotary Foundation your charity of choice. The Foundation consistently receives the highest four-star rating from Charity Navigator, and was recently selected by CNBC as one of the top 10 charities changing the world. That’s right: Our Foundation is ranked near the top of the list of outstanding charities, such as the United Nations Foundation, United States Fund for UNICEF, Direct Relief, and Samaritan’s Purse. The Rotary Foundation consistently maintains its top ranking not only because it is well-managed and transparent, but also because the low overhead of the Foundation allows your contributions to come back so that we can use them for the intended purpose.

We hope that you make The Rotary Foundation your charity of choice. The Foundation consistently receives the highest four-star rating from Charity Navigator, and was recently selected by CNBC as one of the top 10 charities changing the world. That’s right: Our Foundation is ranked near the top of the list of outstanding charities, such as the United Nations Foundation, United States Fund for UNICEF, Direct Relief, and Samaritan’s Purse. The Rotary Foundation consistently maintains its top ranking not only because it is well-managed and transparent, but also because the low overhead of the Foundation allows your contributions to come back so that we can use them for the intended purpose.

Making tax-deductible donations to the Rotary Foundation is easy, and the end of a tax year is a great time to make a charitable contribution. The donations you make to the Foundation are tax-deductible.

Even if you are retired and do not itemize deductions, you may be able to take advantage of the tax laws when donating to the Rotary Foundation. Bud Fortin, past president of the Rotary Club Fitchburg East, points out that you can entirely avoid paying income taxes on donations made directly from your retirement accounts. When you direct the custodian of your retirement account to make a contribution directly from your account to the Rotary Foundation, the contribution will not be included in your income and will count as part of your minimum required distributions. If you take the money as a distribution first, you would pay tax on the distribution. However, if the donation comes directly from your retirement account, there would be no tax paid on the donation!

Whether you can take advantage of the tax deduction or not, we hope you will continue to support the Rotary Foundation. The simple fact of the matter is that without continued donations from Rotarians like you, clubs in our district cannot continue to engage in the service projects at the level we have been. Slow cookers would not be donated to food pantries and senior centers, food banks and pantries would not be stocked, playgrounds and parks would not be improved, and poor sanitation and the diseases that follow would become epidemic. The money you donate to the Foundation comes back and allows us to do the future service projects we are known for.

The easiest way to donate is go online at www.rotary.org/give. Once there, click the “Give Now” box under “Annual Fund and Share.” A secure screen will pop up, and here is what you can do:

1. Click the button next to “Annual Fund – SHARE.”

2. Scroll to the bottom of the page and click “Continue.”

3. Enter the amount of your contribution.

4. Scroll to the bottom of the page and click “Continue.”

5. Complete the billing information and payment type.

6. Scroll to the bottom of the page and click “Continue.”

7. On the summary screen, please review to make sure all the information is entered correctly.

8. Scroll to the bottom of the page and click “Continue.”

9. Enter your credit-card information and click “Submit.”

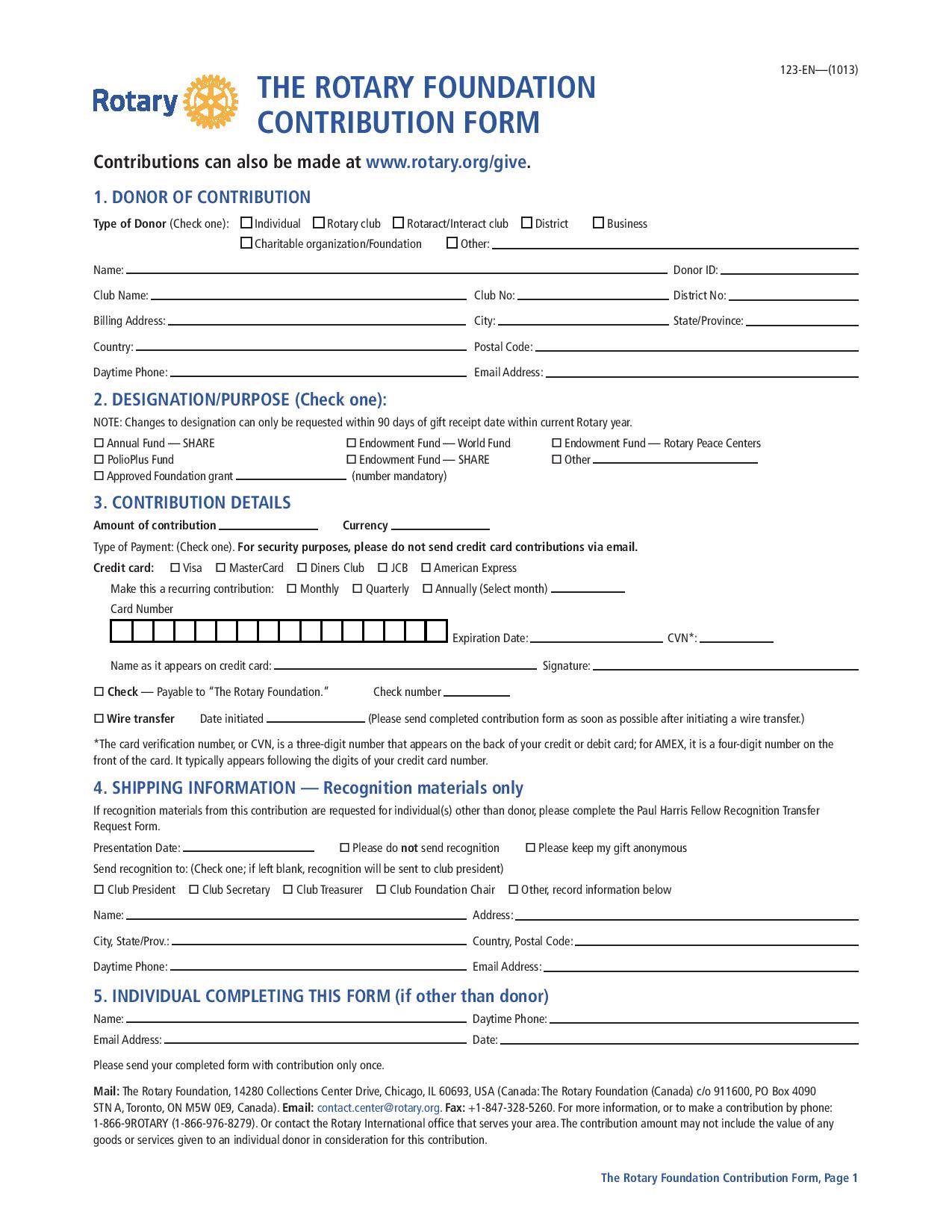

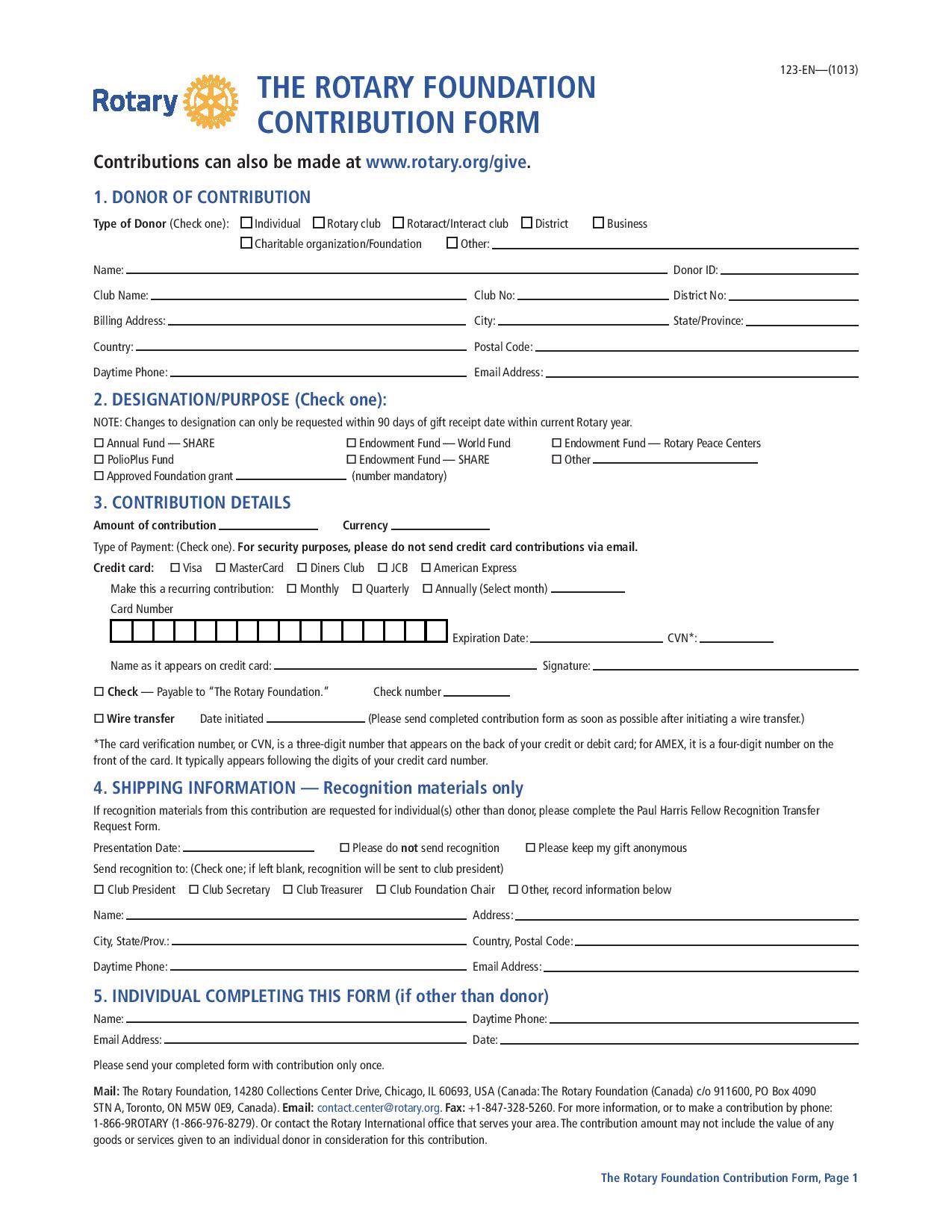

If you prefer to send a physical check, please make it payable “The Rotary Foundation” and write “Annual Fund-Share” in the memo section. To  download the form, in PDF format, click here. Complete the form and mail it and your check to: The Rotary Foundation, 14280 Collections Center Drive, Chicago, IL 60693. Please make sure to check off that your donation is for the Annual Fund-SHARE program. You can even make your contribution by phone by calling Rotary at 866-9-ROTARY (866-976-8279).

download the form, in PDF format, click here. Complete the form and mail it and your check to: The Rotary Foundation, 14280 Collections Center Drive, Chicago, IL 60693. Please make sure to check off that your donation is for the Annual Fund-SHARE program. You can even make your contribution by phone by calling Rotary at 866-9-ROTARY (866-976-8279).

Thank you for all that you do.

download the form, in PDF format, click here. Complete the form and mail it and your check to: The Rotary Foundation, 14280 Collections Center Drive, Chicago, IL 60693. Please make sure to check off that your donation is for the Annual Fund-SHARE program. You can even make your contribution by phone by calling Rotary at 866-9-ROTARY (866-976-8279).

download the form, in PDF format, click here. Complete the form and mail it and your check to: The Rotary Foundation, 14280 Collections Center Drive, Chicago, IL 60693. Please make sure to check off that your donation is for the Annual Fund-SHARE program. You can even make your contribution by phone by calling Rotary at 866-9-ROTARY (866-976-8279).Thank you for all that you do.

Roy Balfour (shown, above, left), 2013-2016 chair of District 7910’s Foundation Committee, may be reached at romart@aol.com, and Steve Sager (shown, above, right), district governor-nominee for 2018-2019, may be reached at ssager@sagerlegal.com.

.jpg)